Efficient bill payment is crucial for maintaining smooth operations, particularly within the treasury functions. The critical role of bill payment extends beyond simple transaction processing to encompass various aspects of financial management, including cash flow optimization and compliance. Over the past decade, bill payment facilitation software has evolved dramatically, transforming from basic electronic payment tools to sophisticated platforms offering a range of features designed to enhance efficiency and security. This evolution has empowered businesses to streamline their financial operations, reduce risks, and focus more on strategic growth.

The Evolution of Bill Payment Software

Traditional bill payment methods rely heavily on manual checks and bank wires. These methods are still widespread despite being inefficient, time-consuming, and posing significant risks. Manual checks required substantial effort to process, while bank wires, although faster, can be expensive and error-prone. And both continue to be subject to significant fraud.

The Automated Clearing House (ACH) network, introduced in 1974, was a significant milestone in electronic payments. ACH allowed businesses and individuals to transfer funds electronically between accounts, replacing the need for physical checks and wires. This system greatly improved the efficiency, security, and cost-effectiveness of bill payments, setting the stage for the sophisticated applications we use today. By providing a standardized method for electronic transactions, ACH made it possible for financial institutions and businesses to handle payments on a much larger and more efficient scale.

Early bill payment software solutions like PayCycle and Bill.com began to appear in the early 2000s, enabling businesses to manage payments more efficiently and securely than traditional methods. These early products aimed to simplify the complex and time-consuming payment process by automating much of the workflow. Despite these advancements, early electronic payment solutions were limited in functionality and integration capabilities, offering only basic improvements over manual processes.

In recent years, platforms like PayPal and Venmo have become popular for personal transactions and even some business payments. However, these tools are not well-suited for managing bill payments for businesses. They lack specialized features for tracking invoices, handling recurring payments, or integrating with accounting systems, which can make them inefficient and cumbersome for bill pay. Using these platforms for business payments often means dealing with fragmented processes and missing out on the advanced features offered by dedicated bill payment solutions.

The Federal Reserve’s FedNow Service, introduced in 2023 as a modern instant payment platform, is transforming the landscape of bill payment software. FedNow facilitates real-time, 24/7 payments between banks, and represents the next leap forward, enabling immediate transfers between accounts at any time of day or night. This instant payment system enhances the speed and convenience of financial transactions, reflecting a continued commitment to improving the payment process for businesses and consumers alike. FedNow’s introduction signifies a major advancement in payment technology, promising to make the financial system faster and more efficient.

As we look to the future, these innovations underscore the crucial role of federal initiatives, as well as private development, in shaping the modern financial landscape and supporting the tools that help businesses manage their finances more effectively.

Modern Bill Payment Software

Modern bill payment software simplifies and secures the bill payment process, supports businesses in maintaining compliance, and looks to integrate seamlessly with their existing financial systems. Here are a few key values modern solutions focus on improving.

Automation and Integration: Bill payment software offers extensive automation capabilities, significantly reducing the manual effort in processing payments. These systems can automatically capture invoices, route them for approval, and execute payments without human intervention. Integration with popular accounting systems like QuickBooks, Xero, and NetSuite ensures seamless data flow and eliminates the need for duplicate data entry, enhancing efficiency and accuracy in financial management.

Security Enhancements: Ensuring secure transactions is a top priority for modern bill payment software. Advanced security measures, such as multi-factor authentication, encryption, and secure user access controls protect sensitive financial information. These systems also provide robust audit trails, allowing businesses to track and verify every transaction, reducing the risk of fraud and ensuring the integrity of financial data. Effective risk mitigation strategies, including fraud detection mechanisms, automated error checking, and transaction validation processes, are integral to managing financial risks and preventing financial losses.

Compliance Features: Staying compliant with financial regulations is crucial for businesses, and modern bill payment software is designed to assist with this. These tools include features that help maintain compliance with tax laws, payment regulations, and other financial reporting requirements. Automated compliance checks, real-time updates on regulatory changes, and detailed reporting capabilities ensure that businesses can meet their legal obligations with minimal effort. Additionally, robust audit and reporting features streamline the process of financial audits and reporting, providing comprehensive transaction records, detailed financial reports, and real-time visibility into payment activities.

By incorporating these key features, modern bill payment software not only simplifies and secures the bill payment process but also supports businesses in maintaining compliance and integrating seamlessly with their existing financial systems. Through these combined efforts, bill payment solutions enhance operational efficiency while ensuring a secure and compliant financial environment.

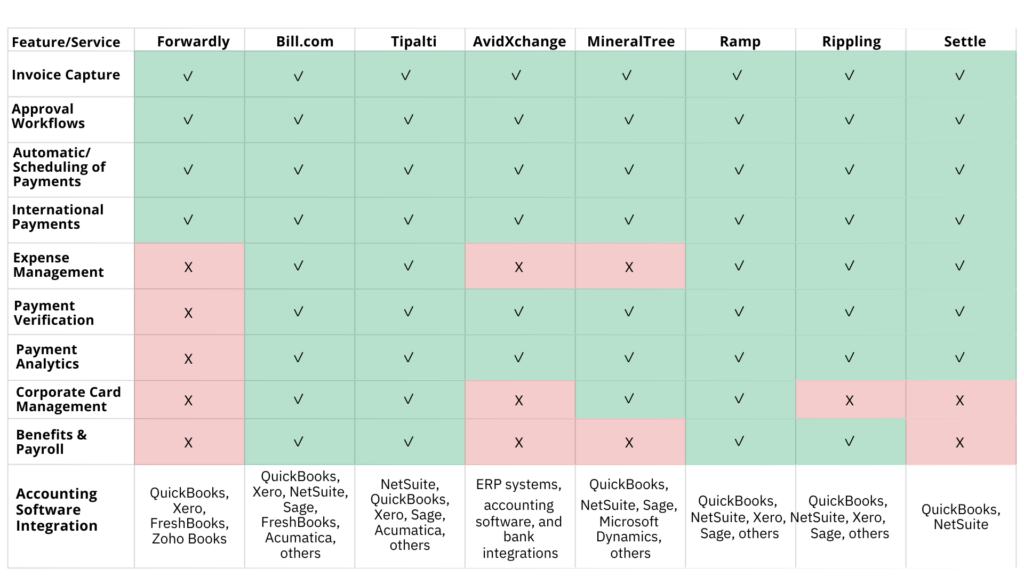

Comparing Top Bill Pay Solutions

The advancements and benefits we’re discussing make the bill payment space ripe for many players. And there are. As implementing a bill pay solution is considered, there are a host of factors and functionality considerations to review. We’ve gathered a few of the top options to compare based on key features such as automation, integration, compliance, global payments, AP automation, instant payments, and additional features. Evaluating these aspects will help provide a structure to find the best fit for a business or client.

Conclusion

In summary, the evolution of bill payment software reflects a significant shift from traditional, manual processes to sophisticated, technology-driven solutions that streamline financial transactions for modern businesses. Today’s bill payment software offers a range of benefits, from automated processes and enhanced security to real-time payment capabilities and comprehensive compliance features. As we look to the future, the potential for widespread adoption of instant payment services, like those offered through the Federal Reserve’s FedNow, promises to further transform the landscape of financial transactions. These advancements will likely drive more businesses to explore innovative solutions that offer greater efficiency, accuracy, and convenience. We encourage businesses to take a closer look at their current bill payment systems and consider adopting advanced software solutions that can meet the demands of a rapidly evolving financial environment. Embracing these technologies positions businesses for success today and prepares them for tomorrow’s opportunities.