If we want to talk about breakthrough financial products, paper was a real killer. Sleek user interface, simple to learn, powerful set of integrated processes, and relatively inexpensive. If we’re being critical, the main drawback to paper (parchment, papyrus, etc.) has always been that you had to learn how to read (and ideally, write) to really get the most out of it as a financial resource, though that could equally be said of key competitors like chiseled marble and baked clay tablets.

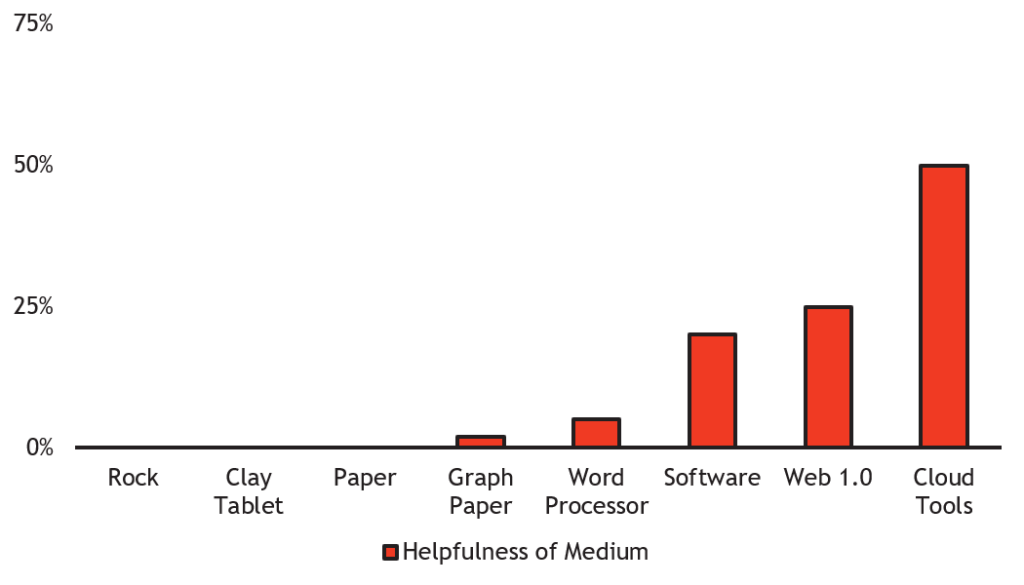

Paper’s historical dominance has shifted of late, and with that shift has come a change in how we distribute work between humans and their tools.

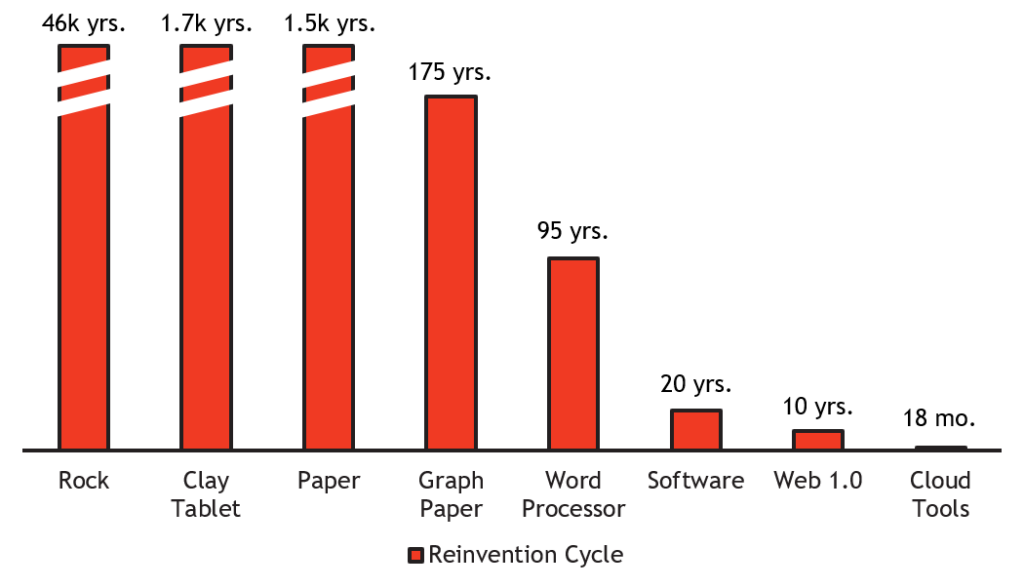

As financial tools become more and more powerful, they’ve shifted the way we think about financial processes. And because our businesses have increasingly become fused to the tools we use, evolutions in those tools have caused us to fundamentally alter the way we structure organizations. Our slow moving financial organizations need to match pace with software innovation cycles. And we’re not always keeping up.

Leading with Tools

You may not be reading a lot of job descriptions for accountants, but perhaps you’re writing some. They always include something like this:

Must be familiar with Quickbooks, Bill.com, Expensify, and Stripe Invoicing, etc.

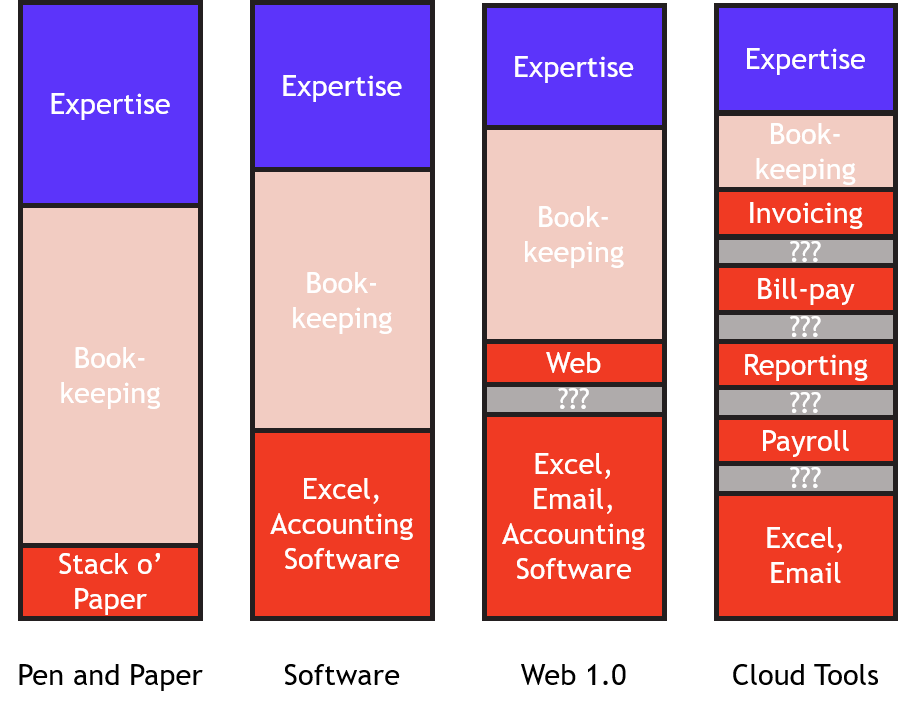

The same goes for Finance folks and their spreadsheets. Our financial process is our tools, and we need people that are familiar with those tools as much (if not more-so) than we need people familiar with the core functions of the organization itself. Let’s look again at the human-tools distribution, but now focus on the human part.

What used to be managed by the expertise and elbow-grease of an individual or team is handled automatically by a software. This allows us to hire fewer employees, who in turn spend time less on tasks that aren’t specifically using their skills. Theoretically, teams are more focused on higher-level work while the tools handle the elbow-grease stuff. Isn’t automation great?

In practice though, there’s a second level of complexity that we’re managing less effectively.

Breaking Down Monoliths

There’s been another shift in financial tools since the internet came along. The number of those tools in the average toolbelt has increased dramatically. While these tools have gotten steadily better, coordinating between the tools has become a task of its own.

If you picture the quintessential old-timey accountant, they’ve probably got a big, fancy pen on their desk. Why does this purely imaginary person have that pen? Because they use it for everything, and everything existed on a page somewhere. The same rules applied even after the early shift to digital, everything was there inside your operating system. Digitization made coordinating between different finance functions a little easier. Rather than digging through file cabinets for a supporting document, you go to your folder system (which we all keep immaculately organized, right?).

But once the internet came along, it became possible to connect systems that didn’t exist in the same place, on the same computer. The web 2.0 created an explosion of different financial products, each specialized rather than generalized. By focusing on a single corner of the market, each of these products could do that one thing far better than the monolithic tools of old.

More and more, the role of humans becomes managing the gaps between the softwares, rather than handling the traditional operational work. And our businesses have often made some faulty assumptions about how that ought to work.

An Overcorrection

With software handling a greater load than ever, there’s a strong temptation to fill in the gaps with whatever we have lying around. Founders are managing invoicing software themselves, product people are spending time managing payroll, large organizations exist without any finance staff at all, or perhaps a single overmatched bookkeeper.

The temptation is understandable, businesses finally have solutions that don’t require expensive, experienced staff to manage basic tasks like getting paid, paying employees, and paying bills. The overcorrection is self-sustaining, the obvious problems (getting paid) are solved while the weaknesses with this approach aren’t immediately obvious unless you have the very skills that these teams are no longer hiring.

Many a business has reached a stage where their reporting and strategic needs grow, only for them to realize what a challenge merging data from one system to another can be. What used to be stored within a single medium is now spread between multiple platforms, each of which will happily dump a 10,000 row CSV in your download folder and consider it a job well done. Isn’t automation great?

No Longer Just a Cost Center

There’s no denying that the role of a finance team has changed drastically, and that software can significantly reduce the need for headcount. The folks that remain need to take a more proactive role in the evolution of an organization; the profiles of those team members may be different that it would once have been.

Finance has traditionally been slow to evolve; frankly, most entrepreneurs would rather focus on their core business than on defining their financial strategy. When the only tools were pen and paper, perhaps a calculator, this was all fine. Entire generations of employees would come and go in between major shifts in process.

As we’ve established, our tools are our process now, and those tools don’t evolve on the financial time-scale. Each tool is a tech solution, and in the tech world you innovate or get crushed. The set-and-forget financial process is gone for good; you can’t wait for your old CFO to retire before reinventing your process. Finance teams need to be constantly reevaluating and reinventing themselves.

By the way, this isn’t just about taxes and reports anymore either. These tools are fundamental parts of your business. Your clients interact with them. Your product team designs around them. You need to understand their limitations, how they connect to each other. And if you’re building a disruptive business you’re unique by necessity; off-the-rack linkages likely aren’t going to cut it.

Building Strong Foundations

Teams have two options in this new universe: they can manage complexity or resolve it. A financial organization can do what’s necessary to keep up with the current level of reporting and record keeping, or they can proactively manage the tech stack, eliminate manual processes, merge data sources together, and create a unified source of truth. You can identify roadblocks proactively, or by slamming into them.

We don’t cut these corners in other parts of our business. Resolving complexity is cheaper in the long run. There are no “special projects” to correct old data when reporting needs evolve. The business has better data to support strategic decision-making. More than ever, acquiring this expertise is a true investment in the future of your business.

Leaky finances are hardly a new phenomenon. Back-offices have been under-resourced since Mesopotamia. But now, when the finance tech stack stands taller than ever, each brick a cost-efficient solution to a complex problem, the temptation remains to cheap out on the mortar. Don’t give in.